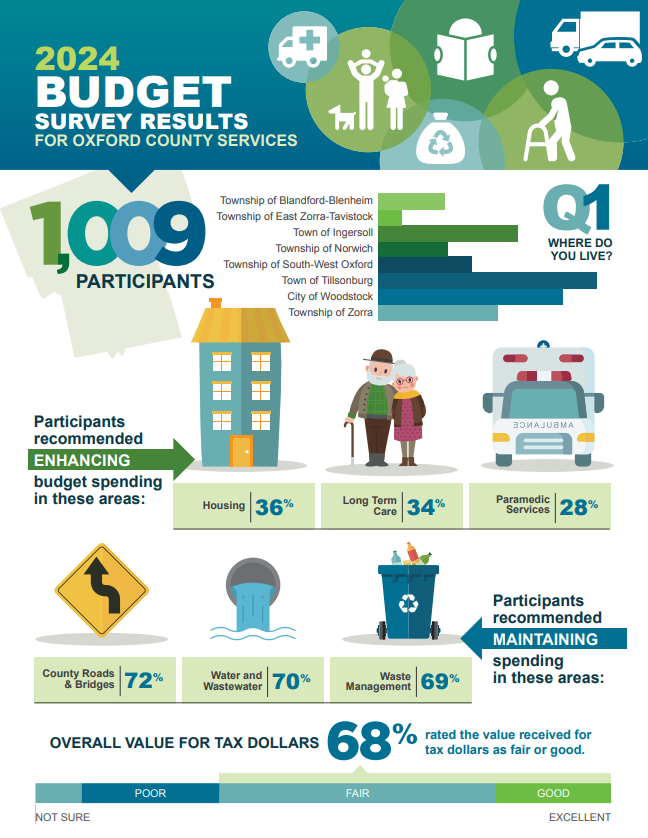

2024 Budget Survey Results

About Municipal Taxes

If you own a residential property in Oxford County, you pay municipal property taxes. The amount collected is based on the value of your property as assessed by MPAC (Municipal Property Assessment Corporation). Your municipal taxes are made up of three parts:

- the amount paid to your local area municipality (South-West Oxford);

- the amount paid to Oxford County; and

- the amount paid to your designated local school board as set by the Government of Ontario.

Oxford County's share of municipal taxes supports road and bridge maintenance on County roads, paramedic services, social services and housing, provincial court, community planning, long-term care at Woodingford Lodge, the County library system (except in Woodstock) and more.

South-West Oxford's share of municipal taxes supports road maintenance on Township roads, fire and emergency services, cemeteries, by-law and animal control, building services, parks and recreation and more. Learn more about property taxes.